To continue reading,

Sign in to access this Premium article.

Subscription entitlements:

Less than $9 per month

3 Simultaneous logins across all devices

Unlimited access to latest and premium articles

Bonus unlimited access to online articles and virtual newspaper on The Edge Malaysia (single login)

Related Stories

- JP Morgan positive on acquisition but raises concern about Keppel DC REIT's $350 mil payout for land extension

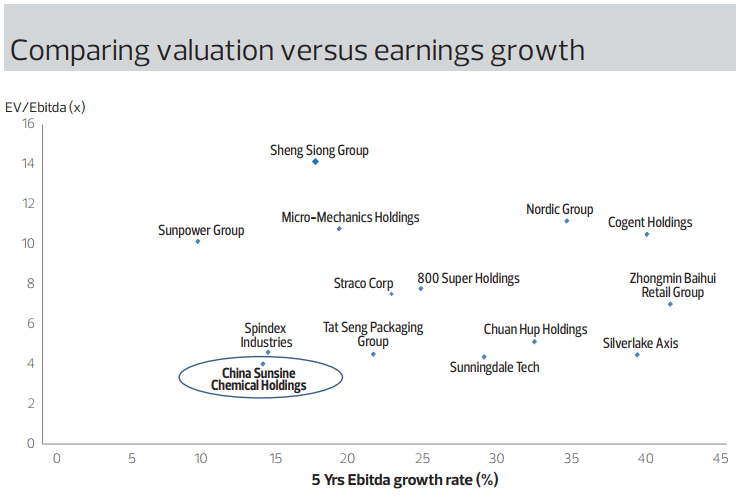

- CGS International positive on China Sunsine’s undemanding valuation

- UOBKH lowers China Sunsine Chemical’s TP to 46 cents with lowered earnings expectations