Billionaires are being minted at a slower pace in Asia, but the demand for professionals to manage their wealth remains strong, as contingencies have to be considered. Are family offices able to provide the much-needed service?

SINGAPORE (Dec 13): Chey Tae-won, chairman of South Korea’s third-largest chaebol, SK Group, could see one of the costliest divisions of personal wealth in Asia. According to Forbes, he is the country’s seventh-richest man, with a net worth of US$4.7 billion ($6.4 billion).

Chey’s wife, Roh Soh-yeong, recently filed for divorce and demanded KRW1.4 trillion ($1.6 billion) worth of shares in SK Holdings Co as part of the settlement. The move is a counterclaim against Chey, who first sought a divorce in 2017. He had confessed to an extramarital affair that produced a love child in a letter sent to a Korean newspaper in 2015. “I now think it’s right to let my husband go find the happiness he wants so desperately,” Roh, 58, posted on her Facebook page on Dec 4. Shares in SK Holdings are marginally down 0.2% year to date, closing at KRW259,500 on Dec 12.

While the Korean drama is set to continue, the potentially huge settlement brings to light the role of family offices in Asia. According to Kwan Chi Man, CEO and founder of Raffles Family Office, his clients are increasingly interested in protecting their wealth, including against a potential divorce. Interestingly, some of these clients are in their 30s, unmarried but in a romantic relationship.

“Our clients are smart. They are looking for ways to protect their wealth and not so much about passing it on to the next generation, [in particular] protecting wealth before [and in a] marriage,” he tells The Edge Singapore in a recent interview. According to Kwan, the divorce rate for millennials in developed countries is close to 50% and divorces usually occur within the first five years of marriage. Hence, “when you have US$300 million in the bank, you have to plan [to protect your wealth],” he adds.

There are other reasons why the rich want to protect their wealth. According to Wealth-X’s Billionaire Census 2019, global billionaire wealth declined 7% y-o-y to US$8.6 billion in 2018 after reaching record levels in the previous year. The global number of billionaires also declined 5.4% y-o-y in 2018 to 2,604 individuals. This is only the second time the billionaire population has dropped since the global financial crisis a decade ago.

The significant decrease in wealth, according to the report, can be attributed to heightened market volatility, global trade tensions and a slowdown in economic growth. The late-year slump in equity markets also wiped out gains made in 2017. In addition, a related strengthening of the US dollar encouraged capital outflows from emerging markets, triggering currency volatility and risk aversion, adds the report.

Notably, Asian billionaires were badly hit. The report points out that all the major Asia-Pacific billionaire countries — China, Hong Kong, India and Singapore — saw a decline in billionaire population and total wealth. Meanwhile, billionaires’ fortunes decreased in Saudi Arabia and the United Arab Emirates, despite positive equity markets and expanding economies. North America was the only region to record an increase in its billionaire population.

Still, the transition of wealth from one generation to the next in Asia will be the single-largest and most crucial activity of family offices in the coming years. According to DBS Private Bank, there will be an unprecedented wave of wealth transfer in 2020 and beyond in the region. “We could see US$2 trillion of wealth landing in the hands of millennials,” Lee Woon Shiu, regional head of wealth planning, family office and insurance solutions at DBS Private Bank, tells The Edge Singapore in an interview.

Cognisant of the opportunities, Singapore is working hard to become a leading wealth management hub on top of its status as a regional financial centre. “We are not resting on our laurels. We continue to build our value proposition for family offices,” says Thong Leng Yeng, executive director of the financial centre development department at the Monetary Authority of Singapore (MAS), in her keynote speech at a DBS Private Banking event.

Family office structure

While family offices emerged in Asia only in the last decade, they have been around for a long time in the West. The Rockefeller family in the US was one of the first to pioneer the family office structure in the 1800s, according to Thong. Today, Rockefeller Capital Management has evolved beyond managing the Rockefeller family’s wealth to that of external clients and their related partnerships, foundations and other entities. RCM’s broader offering includes tax services, accounting, financial planning, budgeting and bill paying.

But, how exactly does a family office look like today? Anuj Kagalwala, asset and wealth management tax leader at PwC Singapore, says one common approach is to have a family-owned fund management company with an in-house investment team. This structure can also include administrative and charity functions, although the key element is the investment team, he says. Alternatively, a family can establish an investment holding company. “When people talk of family offices, they are loosely referring to the set-up of one or two of the above,” he tells The Edge Singapore.

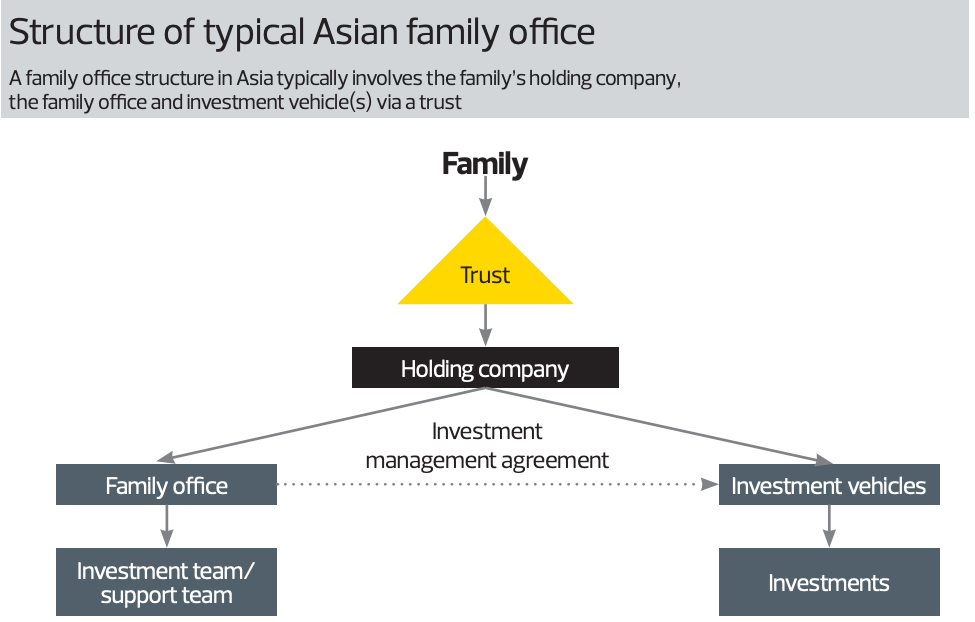

In Asia, the family office structure typically involves a trust at the top, according to EY. Under the trust, the holding company fully owns the family office and investment vehicles. While the holding company owns the investment vehicles, it leaves the day-to-day operations and management of the latter to the family office under an investment management agreement.

Families may choose to establish a single family office. This entity, staffed by family members, will manage the affairs of only the family, with some degree of assistance from professionals such as lawyers, accountants, private bankers and brokers. Alternatively, families could join a multi-family office, which manages the affairs of several families. These entities are usually run by professionals.

According to Thong of MAS, Asian family offices often exhibit characteristics that differ from their Western counterparts. For one — and perhaps the most obvious feature — the decision-making power of Asian family offices is still held by the patriarch or matriarch. “It’s the first generation who is still very much in charge,” she says.

As a result, Asian family offices tend to have a higher risk appetite than their Western counterparts. This is because the first generation are emboldened by their business success and “proven ability to spot winners”, Thong says. Another key difference is that Asian family offices are more likely to recruit members of the next generation than those in the West. “This younger group is well educated, well travelled and not a stranger to technology and innovation. They also have a very keen interest in philanthropy, and environmental, social and governance issues — more so than their parents,” she says.

Thong estimates that the number of family offices globally ranges from 7,000 to 10,000 and about 1,300 of them are in Asia-Pacific. She notes that about 35% of the region’s wealth will be passed on to the next generation within the next five to seven years. “This is higher than in the Western world,” she says.

Growing the ecosystem

So, how is Singapore encouraging the growth of family offices in the country? For one, MAS is working closely with the Economic Development Board (EDB) to build a “strong” network of family offices in the city state, says Thong. The joint initiative, called the Family Office Circle, was launched in June. The platform provides an exclusive setting for family offices to meet their peers to share best practices and partake in co-investment opportunities, she says.

MAS is also working with other government agencies to facilitate easy access to private-market opportunities. For example, the central bank and Enterprise Singapore co-hosted a series of Deal Friday sessions in the lead-up to the Singapore FinTech Festival in November, says Thong. “These are specially curated deal-making sessions that will profile the next generation of Asean start-ups across multiple sectors to connect them to potential investors,” she says.

Thong notes that Singapore already has a world-class infrastructure in place for family offices to thrive. In particular, it serves as the Asian gateway for investments, with total assets under management (AUM) of about $3.3 trillion, she says. Wealth managers and family offices can enjoy access to a “good mix” of asset classes here, she adds. Moreover, Singapore has a trusted legal system to ensure the rule of law, and a vibrant financial system. Hence, wealthy families looking to set up a family office in Singapore should face no problems in procuring the services of a bank or advisers.

Thong adds that MAS recognises that living conditions are one of the important considerations for the location of a family office. “On this front, Singapore has been ranked as the city with the highest quality of living in Asia. Families can certainly look forward to high-quality healthcare, housing and education in Singapore.”

Indeed, family offices are not wasting time in setting up operations here. Raffles Family Office, which started in Hong Kong in 2016, opened its Singapore office on Oct 1. Including its office in Taiwan, the multi-family office has about 110 clients, with total AUM of slightly more than US$2 billion. Raffles Family Office has plans to open two to three more offices across Southeast Asia within the next 12 months. This includes its Shanghai office, which is a joint venture with wealth management fintech company iFAST Corp.

Kwan says the company is rapidly expanding because there is a growing gap in the market. Asia’s economy, which is expanding faster than that of the US and Europe, is creating more billionaires and millionaires, he says. As a result, there is a shortage of family offices in the region.

“Asia will be the main driver of growth in the next few decades,” says Kwan. He was born in Macau and spent his early years in Hong Kong before moving to Singapore for his primary and secondary education in the early 1990s. Subsequently, he went to the UK for his tertiary studies. He currently holds a Hong Kong passport.

Kwan has worked as a private banker at BNP Paribas and Standard Chartered Bank. He says the rich know how to make money, but they do not know how to pass it on to the next generation.

New economy, new money

According to Kwan, most of Raffles Family Office’s clients currently have a liquid net worth of between US$25 million and US$200 million. The company is aiming to attract new and richer clients with a liquid net worth of between US$100 million and US$200 million. While it may be assumed that prospective clients are likely to come from Asean countries, Kwan says clients from Greater China are increasingly looking to engage a family office here. Currently, about 60% of the company’s clients are from Asean, while the remainder are from Greater China.

Asked whether the political turmoil in Hong Kong has led to a shift in wealth to Singapore, Kwan agrees. “Yes, our clients do want to move [their funds]. Some of them feel more comfortable having more assets outside Hong Kong at this point in time,” he says. But he adds that most of the company’s clients already have at least two bank accounts from different jurisdictions. “At the end of the day, diversification is the No 1 rule.”

While Kwan notes that many of his clients had amassed their wealth from traditional industries, such as property, utilities and resources, there are some who made their fortune from new-economy industries. “The newer generation of tycoons are very young — millennials. Most of them own tech companies, which have been operating for the last five to 10 years. Half of [these companies] are listed in the US, Hong Kong or China,” he says.

Banks, too, want a slice of the action. While DBS Private Bank has all along provided services to meet the needs of its highnet-worth clients, it established a family office unit in March. Lee explains that by having a dedicated family office unit, the private bank is better able to meet the needs of its clients.

In particular, many of the family members — especially the younger generation — are spread out all over the globe. While the patriarch and matriarch still reside in their home country, many of their children and grandchildren live overseas as a result of studies or marriage.

“That’s where there is a need to be aware of the exposure of these [family] members [in terms of] taxes, matrimonial asset protection and creditor protection across different jurisdictions,” Lee says. “Our clients have more complex needs and the demographics are interesting. Hence, we need a dedicated unit with hard and soft skills, coupled with experience, to handle them.”

Lee says China is a “key” growth market for DBS Private Bank. Although previously, Beijing and Shanghai were the breeding ground for billionaires and millionaires, it has now shifted to Hangzhou and Shenzhen, with the latter being the headquarters of Tencent Holdings and Huawei Technologies. “The speed of growth there is astonishing,” he notes.

Asean counries are also a lucrative market for DBS Private Bank. It has partnered with DBS Vickers Securities (Thailand) to double its AUM in that country to $8 billion by 2023. It also aims to double its headcount for wealth relationship managers there over the same period. Lee notes that Indonesia is also a core market for the private bank. Of course, Singapore is an important market too. “We fully intend to guard our turf,” he says.

‘Butler’ to the rich

Do rich families really need a family office? Shantini Ramachandra, Deloitte Private Southeast Asia tax leader, says families should first and foremost consider their objectives and needs in setting up a family office or joining a multi-family office. This includes the portion of wealth and desired level of control to be managed by the family office. They also need to consider the investment strategy and the classes of assets to invest in.

In the case of a divorce, a family office under a trust structure could help minimise loss of wealth. PwC Singapore’s Kagalwala says the family could set up a discretionary irrevocable trust to hold the family’s assets. This trust is administered by an independent trustee company, which has the discretion to distribute the trust assets and income.

“On the basis that the family members are not entitled to the assets held by the trust and the assets are not in their legal or beneficial name, in the event [of claims by creditors or a spouse following a divorce], a certain level of protection may be available to the family member against the claimant,” Kagalwala says.

Ramachandra is of the same opinion. She says the establishment of a family office provides an opportunity for families to create a framework to manage their wealth. This framework covers issues — such as decision-making mechanisms, roles and responsibilities, investment parameters and strategy, monitoring and reporting — by establishing policies and procedures. The framework may be further strengthened by having a written family constitution, she adds.

“In the example of a divorce, a typical family constitution drafted in conjunction with the setting up of a family office would have addressed spousal entitlement, as well as spousal roles within the family enterprise, thereby obviating the risk of disputes concerning the family’s wealth in the event of divorce,” she says. “A trust structure adds another layer of protection, as a trustee would ensure distributions to the rightful beneficiaries.”

Aside from facilitating the transfer of wealth, family offices can also help minimise taxes. Lee of DBS Private Bank says families need to have tax certainty in the light of complex demographics and jurisdictions. In Singapore, there are three tax incentive schemes for funds: Section 13CA, Section 13R and Section 13X of the Income Tax Act. These tax incentive schemes exempt family investment vehicles — both in and outside the city state — from paying taxes on specified income derived from designated investments.

These investment vehicles must meet prescribed conditions, and may also require upfront approval from the Singapore authorities to enjoy the exemptions. For family office structures, the investment vehicles used are typically companies incorporated in or outside Singapore. “The MAS licencing schemes currently apply to single family offices,” says Lee.

Apart from that, family offices can provide a platform for investment opportunities that are not readily available elsewhere. In particular, co-investments are becoming a trend among rich families. “There are more and more family offices coming together to network and engage. We provide them the platform so that they can talk among themselves. For example, a client who has an F&B business in Thailand may want to reach out to his peer with a similar business in Indonesia. Family offices can pool resources to invest in a project,” Lee says, adding that clients can invest in DBS’ PE Access programme.

Lee says a family office can provide a “sandbox” for the younger generation to try their hand at setting up new businesses or investments. This may allow them to realise their dreams, without venturing too far from the fold of the family. “So, it’s like an incubator of sorts,” he says.

Kwan of Raffles Family Office prefers to think of family offices — particularly those that are independent of any bank — as playing a role similar to that of a butler. “Imagine you have an apartment. You probably need a part-time helper. But if you have a house, you get a full-time helper. If you have a mansion, then you need a butler. He will represent you in the day-to-day running of your property. He will manage the security guards, cleaners and gardeners for you,” he says.

On whether to set up a single family office or join a multi-family office, Deloitte’s Ramachandra says the latter may help to achieve economies of scale and efficiency for less wealthy families. This is achieved through the co-sharing of certain costs and pooled purchasing power, and by having experienced talent serve the families.

PwC Singapore’s Kagalwala, however, says it need not be mutually exclusive. This is because the investment team in the single family office may not have the investment capabilities in certain markets. In such circumstances, a single family office may appoint a multi-family office to provide investment advisory services, he says. “One of the key factors in deciding whether to set up a single family office is the level of wealth or the investment portfolio in question. The greater the value, the higher the likelihood of setting up a single family office, though this is not the only factor and may not be the most important one.”

It is not immediately clear whether SK Holdings’ Chey has a family office to help him minimise the loss of his wealth as a result of an impending divorce. Chey’s wife, Roh, is no pushover. After all, she is the daughter of South Korea’s former president, Roh Tae-woo. Will the parties involved settle quickly or will more drama ensue? In any case, what is certain is that the ultra -rich in Asia will require the right expertise to manage and protect their wealth. The family office might just fill that gap.