SINGAPORE (Oct 7): EuroSports Global (ESG), a distributor of luxury cars, has been buying back its own shares from the market. In the past month, it bought back about 451,000 shares, amounting to a 0.17% stake in the company.

On Sept 26, it bought 50,000 shares from the market at 18.5 cents each. Just three days later, it bought another 180,000 shares at 18.8 cents apiece. On Oct 1, it bought 100,000 shares at 19 cents each, followed by 60,000 shares at 19.2 cents apiece a day later. On Oct 3, it bought another 61,000 shares at 19.5 cents each.

In total, the group spent about $85,000 on the purchases. Following the latest purchase, the company has a total share base of 261.8 million shares and another 3.2 million treasury shares.

ESG has been on a share buyback spree since February. It has made more than 20 buyback transactions since then.

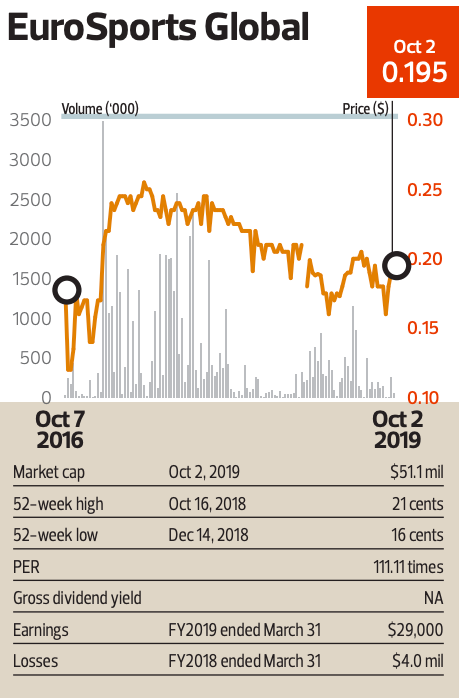

Year to date, shares in ESG have increased 8.3% to close at 19.5 cents on Oct 2. However, the stock is down 40.6% from the 32 cents it attained when it made its debut on the Singapore Exchange in January 2014.

For FY2019, the group moved back into the black and recorded earnings of $29,000, compared with a loss of $4 million in FY2018.

This came on the back of a 58% increase in revenue to $96.2 million, from $60.9 million in the previous year, which the group attributed mainly to higher sales in new automobiles, such as the Lamborghini Urus, Alfa Romeo Giulia and Alfa Romeo Stelvio.

During the period, the group did not declare any dividends, as it said it had to conserve cash for business growth and opportunities.

Moving forward, the automobile industry is expected to remain competitive and challenging, especially in Singapore’s highly regulated environment. But the group remains cautiously optimistic about the prospects of the automobile distribution segment.

The group is looking forward to a reasonable performance over the next 12 months, given the strong traction and bookings placed on the new Lamborghini and Alfa Romeo models.

However, the group says its subsidiary, EuroSports Technologies (EST), will continue to incur expenses for the next 12 months, in line with its push to develop and launch new, sustainable and economic urban mobility solutions (electric motorcycles).

In December 2018, EST received $2 million of seed capital from ESG, with a commitment of another $3 million, subject to certain milestones. These funds will be used to accelerate the development of EST’s Singapore-developed electric motorcycle.

Apart from automobiles, ESG is also in the business of luxury watch distribution through its subsidiary, deLaCour Asia Pacific. In 2012, the group became the exclusive distributor for the deLaCour brand of watches, jewellery and accessories in Singapore, Malaysia, Thailand and Brunei.

In its latest annual report, the group says it will continue to review this business. While it believes that deLaCour is a desirable brand with unique designs and mechanisms, it will reassess marketing efforts before deciding on the next step.

Meanwhile, the group is looking into other luxury businesses and products to expand its portfolio, as well as seeking out strategic partnerships and joint ventures that can complement its existing or future businesses.