SINGAPORE (Dec 9): Beer and property do not always mix, but the family business of Thai tycoon Charoen Sirivadhanabhakdi has been busy shuffling its assets in the two industries. Besides the proposed merger of its two Singapore real estate investment trusts, its other operating company, Thai Beverage (ThaiBev), is reportedly planning a listing of its brewery business on the Singapore Exchange and seeking a valuation of US$10 billion ($10.6 billion).

While ThaiBev is known for its Chang beer, it has over the years built and acquired a sprawling portfolio of alcoholic and non-alcoholic drinks manufacturing and foodstuff manufacturing businesses.

On Nov 29, in a response via SGX to a Bloomberg report earlier that day, ThaiBev acknowledged it was exploring a potential listing, though it was still at the “early stages”. It said there was no certainty or assurance that such a move would proceed.

“To this end, ThaiBev is presently evaluating strategic proposals and opportunities, including but not limited to a potential listing of its beer business, in consultation with its external advisors,” the company said in a filing with SGX.

The separate listing, according to Bloomberg, might include its operations in Thailand and 53.58%-owned subsidiary Saigon Beer-Alcohol-Beverage Corp (Sabeco) in Vietnam. If the US$10 billion valuation at listing is achieved, it will be the biggest IPO ever on the SGX since the US$5.4 billion IPO of Hutchison Port Holdings Trust in 2011. Reports have quoted sources as saying that the IPO could raise between US$2 billion and US$3 billion.

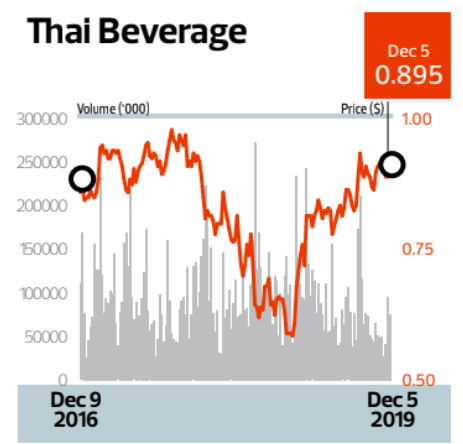

Following the Bloomberg report, ThaiBev shares rose 3% from the previous day’s close of 86.5 cents to end at 89 cents on Nov 29. The stock has since moved marginally higher to close at 89.5 cents on Dec 5, giving the company a market capitalisation of $22.48 billion. The counter has gained 46.7% year to date and is approaching its 12-month high of 93.5 cents on Aug 23.

On the whole, analysts are cheering the potential listing, given the steady growth in beer consumption in Asean. This should help to lift ThaiBev’s valuations, which are relatively lower than its regional peers’. “As a holding company (ThaiBev), they will get better value for their subsidiary [listed brewery business],” Nirgunan Tiruchelvam, head of consumer sector equity research at Tellimer, tells The Edge Singapore. “The spin-off would be a positive note.”

UOB Kay Hian analyst Lucas Teng estimates that the listed brewery business could be valued at an enterprise value of 23 times its earnings before interest, tax, depreciation and amortisation. This is assuming ThaiBev aims for a US$10 billion valuation and that it accounts for the segment’s interest-bearing liabilities and minority interest. “This is higher than peers’ average of 15 times. We estimate that Sabeco is currently trading at approximately 20 times EV/Ebitda,” he writes in a Dec 3 note.

Teng says ThaiBev’s expansion plans for its brewery production may provide an “impetus” for the potential listing. Sabeco recently constructed a brewery with a total production capacity of two billion litres a year. Through its indirect associate company Fraser and Neave (F&N), ThaiBev also commenced brewing Chang Beer in Myanmar in September. The brewery in Yangon has an annual production capacity of 50 million litres, he notes.

Aside from obtaining a higher valuation for its brewery business, other positives from the listing could include moving some of ThaiBev’s debt off its balance sheet. Whether that happens and to what extent remains to be seen, says Tiruchelvam. Teng adds that the potential IPO could also prompt Budweiser Brewing Co APAC to “venture into the group”, given its interest in the Vietnam beer market.

Cheers to a good year

ThaiBev has on the whole performed well this year and is expected to do better. That would limit any potential downside to the company’s share price in the future. For FY2019 ended Sept 30, ThaiBev’s spirits business recorded a y-o-y revenue growth of 8.6% to THB115.04 billion ($5.18 billion). This came on the back of a higher Thai sales volume of 577.8 million litres, up 7.9% y-o-y. Including sales by its 75%-owned subsidiary Grand Royal Group in Myanmar, total sales volume rose 8.9% y-o-y to 666.5 million litres.

In terms of earnings, the spirits business recorded y-o-y growth of 12.9% to THB19.16 billion as Ebitda improved on the back of a higher gross profit. However, this was offset by an increase in past service cost for employee benefits of THB391 million, owing to an amendment in the Labor Protection Act.

ThaiBev’s beer business also posted higher sales revenue growth of THB119.6 billion, up 26.6% y-o-y. This came mainly on higher Thai sales volume of 804.1 million litres, up 7.4% y-o-y. Including sales of Sabeco’s beer, total sales volume surged 31% y-o-y to 2.7 billion litres.

Nevertheless, the beer business registered lower earnings of THB826 million, down 36% y-o-y, mainly due to an increase in finance costs. The increase in advertising and promotion expenses, and past service cost for employee benefits, contributed to the drop.

ThaiBev’s non-alcoholic beverages business chalked up y-o-y revenue growth of 7.5% to THB17.39 billion. This came on the back of higher sales volumes of drinking water, carbonated soft drinks and ready-to-drink tea, but was offset by lower sales volumes of Jubjai, 100Plus and Lipton. As a result, the non-alcoholic business, which has been in the red, narrowed its losses to THB1.05 billion from THB1.32 billion.

The company’s food business, meanwhile, posted y-o-y revenue growth of 17.3% to THB15.56 billion. This was mainly due to an increase in revenue from Oishi Group and The QSR of Asia Co. The former operates a variety of Japanese restaurants and ready-to-cook and ready-to-eat products, while the latter operated 268 KFC outlets in Thailand as at Sept 30, 2018.

However, earnings from the food business tumbled 19.5% y-o-y to THB418 million, owing to an increase in finance costs. The increase in advertising and promotion expenses, and past service cost for employee benefits contributed to the fall.

Finally, earnings contributions from associate companies F&N and Frasers Property jumped 31% y-o-y to THB3.92 billion. Overall, ThaiBev recorded total sales revenue of THB267.36 billion, up 16.4% y-o-y. Ebitda rose 19.9% y-o-y to THB45.1 billion and total earnings increased 13.8% y-o-y to THB23.27 billion.

High leverage concern

Should investors consider buying into the stock? JPMorgan says it continues to see upside in ThaiBev on the back of positive volume momentum in the Thai market over the next few quarters. This is due to improving demand from rice-growing regions, he explains.

“Weak economic data recently will likely pressure the government to maintain the intensity of consumption stimulus, in our view, sustaining strong volume growth for the domestic business going into high seasons,” JPMorgan analyst Kae Pornpunnarath writes in a note dated Nov 23.

Progress on achieving synergy with Sabeco could also drive the stock’s rerating. JPMorgan says ThaiBev stands to gain potential market share in Vietnam after a recent major rebranding and packaging at Sabeco. “The acquisition of an overseas business portfolio has unlocked ThaiBev’s portfolio growth potential [versus] the relatively saturated domestic liquor market,” Pornpunnarath says.

In addition, ThaiBev could see a near term volume payback in overseas markets in the upcoming quarters, says JPMorgan. This comes after an inventory de-stock in the trade channel occurred in both Vietnam and Myanmar, owing to a rebranding exercise in the former and a temporary production hiccup in the latter.

Phillip Capital, however, is “negative” on ThaiBev in the medium term. The brokerage reckons Sabeco will remain an earnings drag on the company, owing to high interest expenses, in addition to soft consumer spending in Thailand that will be dependent on government support. Phillip Capital also believes spirits consumption in Thailand has reached maturity. This prompted the brokerage to cut its FY2020 earnings forecast by 5% on the back of lower margins and higher interest expense estimates.

ThaiBev’s high leverage level is a concern, too. The company had a net interest bearing debt-to-equity ratio of 1.3 times as at Sept 30, 2019, versus 1.34 times a year ago. While noting the marginal improvement, DBS Group Research stresses that the debt level is still high.

Nevertheless, DBS believes deleveraging will be the company’s key priority. “With its Thai domestic operations seemingly on the cusp of recovery after the weak consumption in 2017/18, we believe the focus now would be on the group’s deleveraging strategy going forward,” DBS analysts Andy Sim and Alfie Yeo write in a Nov 24 note.

JPMorgan has kept its “overweight” rating for the stock and raised its price target to $1 from 96 cents previously. DBS has also maintained its “buy” call for the stock and raised its price target to $1.04 from 91 cents. Phillip Capital, however, has downgraded the stock to a “reduce” call and lowered its price target to 80 cents from 83 cents previously.